Once the face of Tesla’s bold innovation and Elon Musk’s vision for the future of transportation, the Cybertruck is now shaping up to be one of the company’s most high-profile missteps. With an estimated $200 million worth of unsold Cybertruck inventory gathering dust in warehouses, Tesla’s challenges are snowballing — and so are customer complaints.What was once a futuristic symbol of disruption has now become a case study in over-promising and under-delivering.When Elon Musk first pulled the wraps off the Cybertruck in 2019, it felt like a watershed moment. The polarizing design, exoskeleton made from ultra-hard stainless steel, and claims of unbeatable utility sparked an avalanche of preorders. With hundreds of thousands of reservations and years of buzz, the vehicle was expected to redefine electric pickups and help Tesla enter a new segment of the EV market.However, fast-forward to early 2025, and that dream appears to be unraveling.

According to a Tuesday report from EV news outlet Electrek, Tesla has been quietly refusing to accept Cybertrucks as trade-ins — even from customers seeking to swap them for other Tesla vehicles. Owners are now reporting they’ve been turned away by Tesla sales representatives and directed toward state “Lemon Law” processes to resolve their grievances.“It’s bizarre. I tried trading in my Cybertruck for a Model Y and was flat-out told, ‘We’re not taking Cybertrucks right now,’” said one owner, who asked to remain anonymous due to ongoing negotiations with Tesla’s legal team. “They’re treating their own flagship product like radioactive waste.”The implication that Tesla is effectively disowning its own product raises questions not just about the vehicle itself, but about Tesla’s commitment to customer service. Lemon laws exist to protect buyers from defective vehicles by requiring manufacturers to buy them back or replace them after multiple failed repair attempts.But most automakers work to resolve issues before legal action is necessary.For Tesla, however, the Lemon Law is becoming the de facto remedy for frustrated Cybertruck owners. Some users report their trucks have spent weeks — even months — in service centers due to a variety of issues ranging from software malfunctions to structural problems.One widely reported defect involved an exterior panel that could detach while the vehicle was in motion, prompting Tesla to issue a sweeping recall earlier this year. The company has yet to comment on how many vehicles were affected or what long-term fixes are in place.

Perhaps most telling of all is the growing mountain of unsold Cybertruck inventory. According to Electrek, Tesla is currently sitting on approximately $200 million worth of Cybertrucks that have yet to find buyers — an enormous figure that represents both lost revenue and manufacturing waste.Warehouse employees in Fremont, California, and Giga Texas reportedly describe “rows and rows of unsold Cybertrucks” occupying space that was once reserved for the high-demand Model 3 and Model Y.This excess inventory comes at a time when demand for Tesla vehicles in general is softening. On Wednesday, Tesla revealed a 13% year-over-year decline in deliveries for Q1 2025, totaling 336,681 units. The figure represents a significant drop from 387,000 deliveries during the same period in 2024 — and a massive miss compared to the 408,000 units projected by analysts surveyed by FactSet.The declining sales numbers are part of a broader trend. Tesla’s once-dominant product lineup is beginning to show signs of age. The Model S and Model X — introduced in 2012 and 2015, respectively — have not received major platform overhauls in years.Meanwhile, competitors like Rivian, Ford (with its refreshed F-150 Lightning), and even legacy manufacturers such as GM and Hyundai are rolling out modern EVs with cutting-edge features and more competitive pricing.

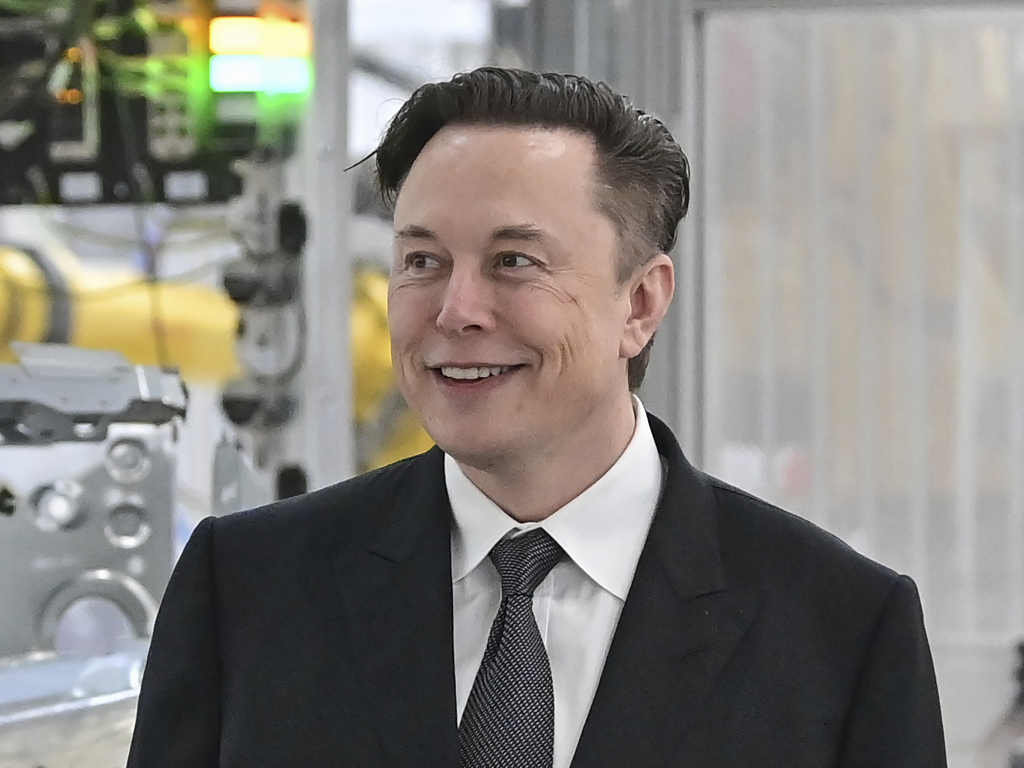

Tesla has responded with aggressive discounts, zero-interest financing, and even free Full Self-Driving (FSD) trial packages to entice buyers — but the incentives don’t appear to be reversing the trend.“Cybertruck was supposed to be the growth catalyst, not the anchor dragging down margins,” said Jessica Caldwell, Executive Director of Insights at Edmunds. “It’s emblematic of Tesla’s current problem: hype can only carry you so far. At some point, you have to deliver a product that meets expectations.”Tesla’s troubles aren’t just technical or financial — they’re increasingly political and cultural.Since the 2024 U.S. presidential election, CEO Elon Musk has doubled down on his support of conservative policies and political figures. In his role as Chair of the Department of Government Efficiency — a controversial appointment under President Donald Trump’s second administration — Musk has advocated for slashing federal spending, including subsidies for electric vehicles and renewable energy.That stance has created a rift with Tesla’s traditional customer base, which historically leaned progressive and environmentally conscious.Protests have broken out at Tesla showrooms in California, New York, and Oregon, where former customers and climate activists accuse Musk of abandoning the company’s green mission in favor of political ambition.

“Elon’s turned the company into a culture war battlefield,” said one protestor outside a Tesla showroom in San Francisco. “We supported Tesla to fight climate change, not to dismantle clean energy programs.”Unsurprisingly, the string of bad headlines is shaking investor confidence. Tesla shares are down nearly 35% year-to-date, and Wednesday’s delivery numbers only accelerated the slide. With the company’s Q1 earnings report expected later this month, many are bracing for additional disappointments.”There’s a clear divergence between brand equity and operational performance,” said Dan Ives, Managing Director and equity analyst at Wedbush Securities. “If Tesla can’t regain the trust of its customers and investors, we’re looking at long-term erosion in market leadership.”Ives also noted that many institutional investors are beginning to question Musk’s dual role as both a public servant and the head of a publicly traded company — especially given recent regulatory scrutiny over Tesla’s accounting practices and alleged FSD exaggerations.Tesla has remained largely silent on the trade-in refusals and Cybertruck dissatisfaction. There has been no official guidance issued on how the company plans to address the $200 million in inventory, nor has there been a formal apology or remediation process offered to owners experiencing ongoing issues.

Insiders speculate that Tesla may attempt a “refresh” or scaled-back rebranding of the Cybertruck later this year. Others suggest a quiet end to the model altogether, focusing instead on upcoming projects like the Robotaxi platform and the next-gen Model 2.For customers still holding out hope for a turnaround, the lack of communication is frustrating. “I love the idea of Tesla,” said Amanda Chen, a former Cybertruck owner from Nevada. “But the execution has been a disaster. I don’t know if I’ll ever buy another one.”The fall of the Cybertruck is no longer just a bad quarter — it’s a reckoning in real time for Tesla. Between the $200 million of dusty inventory, the refusal to stand by its own product, and the growing discontent from customers and investors alike, Tesla finds itself at a critical crossroads.Whether the company can pivot — and whether Elon Musk can realign his vision with consumer reality — remains to be seen. For now, the Cybertruck stands not as a symbol of the future, but as a mirror reflecting Tesla’s mounting missteps.And in a fast-moving industry with no shortage of competitors ready to take the lead, second chances are becoming increasingly rare.